All Categories

Featured

Table of Contents

That generally makes them an extra affordable option for life insurance protection. Several people get life insurance protection to help economically secure their loved ones in case of their unanticipated death.

Or you might have the choice to transform your existing term coverage right into a permanent policy that lasts the remainder of your life. Numerous life insurance coverage plans have prospective benefits and downsides, so it's crucial to understand each before you decide to buy a plan.

As long as you pay the costs, your recipients will certainly obtain the death benefit if you pass away while covered. That claimed, it is necessary to keep in mind that a lot of plans are contestable for two years which suggests insurance coverage can be retracted on death, ought to a misstatement be discovered in the app. Policies that are not contestable often have actually a rated death advantage.

Is Term Life Insurance the Right Fit for You?

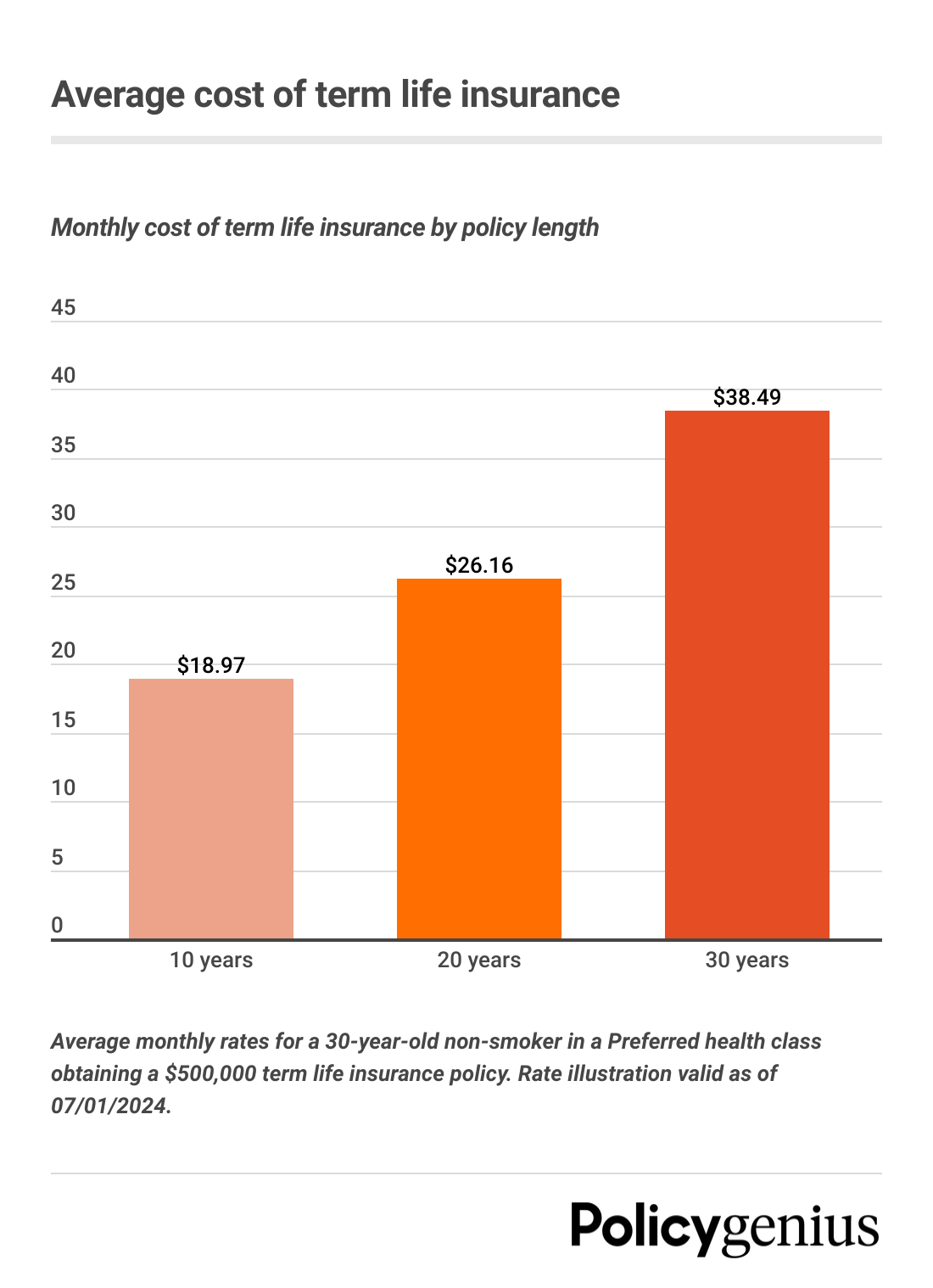

Premiums are typically lower than entire life policies. You're not secured into a contract for the remainder of your life.

And you can not squander your policy during its term, so you won't receive any monetary take advantage of your previous coverage. As with various other kinds of life insurance, the price of a level term plan depends on your age, insurance coverage requirements, work, way of living and wellness. Normally, you'll find much more cost effective protection if you're younger, healthier and less high-risk to guarantee.

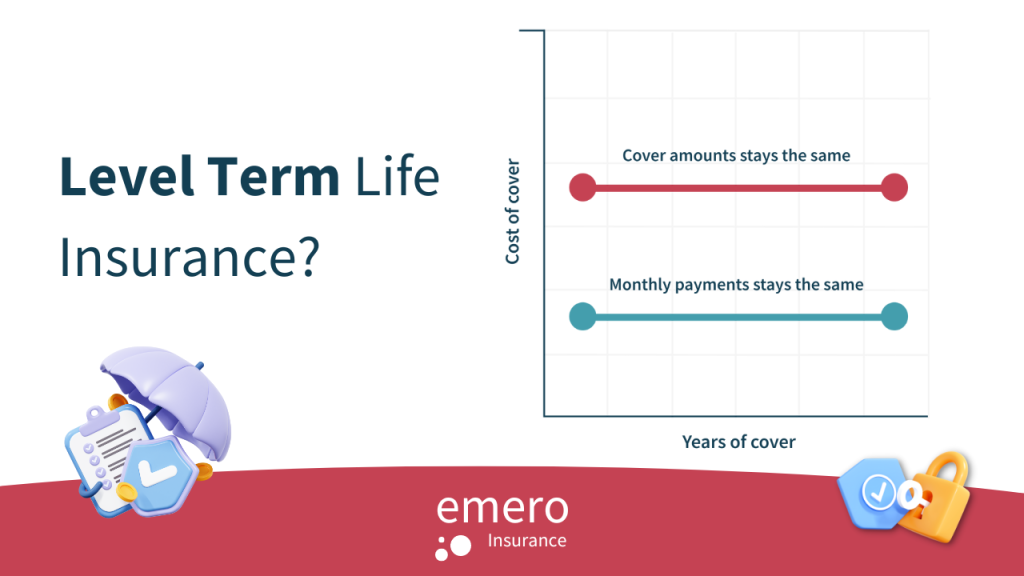

Considering that level term premiums stay the exact same for the period of insurance coverage, you'll know specifically just how much you'll pay each time. Degree term coverage additionally has some flexibility, allowing you to personalize your policy with extra functions.

What is What Does Level Term Life Insurance Mean? Pros, Cons, and Features

You may have to meet specific problems and certifications for your insurer to enact this rider. There likewise might be an age or time limit on the protection.

The death benefit is generally smaller, and coverage usually lasts until your child transforms 18 or 25. This biker might be a more cost-effective means to aid guarantee your youngsters are covered as cyclists can frequently cover numerous dependents at when. When your kid ages out of this coverage, it may be feasible to convert the rider into a brand-new policy.

When comparing term versus long-term life insurance policy, it's vital to keep in mind there are a few different types. The most common type of long-term life insurance coverage is entire life insurance coverage, yet it has some vital distinctions contrasted to level term insurance coverage. Simplified term life insurance. Right here's a basic introduction of what to take into consideration when comparing term vs.

Entire life insurance policy lasts forever, while term protection lasts for a specific period. The premiums for term life insurance policy are normally less than entire life protection. With both, the costs continue to be the same for the period of the plan. Whole life insurance coverage has a cash value element, where a part of the costs might grow tax-deferred for future requirements.

One of the primary attributes of level term protection is that your costs and your fatality benefit do not change. You may have insurance coverage that starts with a death advantage of $10,000, which might cover a mortgage, and after that each year, the death advantage will reduce by a set amount or percentage.

Because of this, it's typically a much more economical sort of level term insurance coverage. You might have life insurance policy via your employer, however it may not suffice life insurance policy for your requirements. The very first step when purchasing a plan is identifying just how much life insurance policy you require. Take into consideration aspects such as: Age Family dimension and ages Work condition Income Financial obligation Way of living Expected final costs A life insurance coverage calculator can aid establish how much you require to start.

What Exactly Is Term Life Insurance For Spouse Coverage?

After selecting a policy, finish the application. For the underwriting procedure, you may need to offer basic personal, health and wellness, lifestyle and employment information. Your insurer will figure out if you are insurable and the risk you may provide to them, which is shown in your premium costs. If you're authorized, sign the paperwork and pay your very first costs.

You might want to upgrade your beneficiary info if you have actually had any significant life adjustments, such as a marital relationship, birth or separation. Life insurance can often feel complex.

No, degree term life insurance policy doesn't have money value. Some life insurance policy policies have a financial investment feature that enables you to build money value with time. A part of your costs settlements is established aside and can gain interest gradually, which expands tax-deferred throughout the life of your coverage.

However, these plans are typically significantly a lot more costly than term protection. If you reach completion of your plan and are still active, the coverage ends. You have some choices if you still desire some life insurance policy coverage. You can: If you're 65 and your protection has actually run out, for example, you may wish to acquire a new 10-year level term life insurance policy.

What is Simplified Term Life Insurance? An Overview for New Buyers?

You might have the ability to transform your term insurance coverage right into a whole life plan that will certainly last for the rest of your life. Numerous kinds of level term plans are exchangeable. That indicates, at the end of your protection, you can transform some or all of your plan to whole life protection.

A level premium term life insurance policy plan lets you stay with your budget while you help shield your household. Unlike some stepped price plans that raises each year with your age, this sort of term strategy uses prices that stay the exact same through you select, even as you age or your wellness modifications.

Find out a lot more regarding the Life insurance policy choices readily available to you as an AICPA participant (Term life insurance with accelerated death benefit). ___ Aon Insurance Coverage Providers is the trademark name for the brokerage firm and program management procedures of Affinity Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Services Inc.; in CA, Aon Fondness Insurance Policy Services, Inc .

Table of Contents

Latest Posts

Burial Insurance Pro

Burial Insurance Plans

Aarp Burial Insurance Rates

More

Latest Posts

Burial Insurance Pro

Burial Insurance Plans

Aarp Burial Insurance Rates